Continuous Diligence

Less effort, more insight on tech

Reporting shouldn’t slow you down. Translating complex tech KPIs into business-focused metrics is a recurring headache, especially when every report looks different, speaks a different language, or takes hours to prepare.

That’s where Vaultinum comes in. We overtake the the entire reporting process, from the initial tech performance assessment to on-going monitoring, turning technical insights into business-aligned updates that make sense. Our mission is to ensure that the tech execution translates into value creation and improves exit-readiness.

So you stay focused on delivery while we handle the narrative.

Continuous clarity across the portfolio

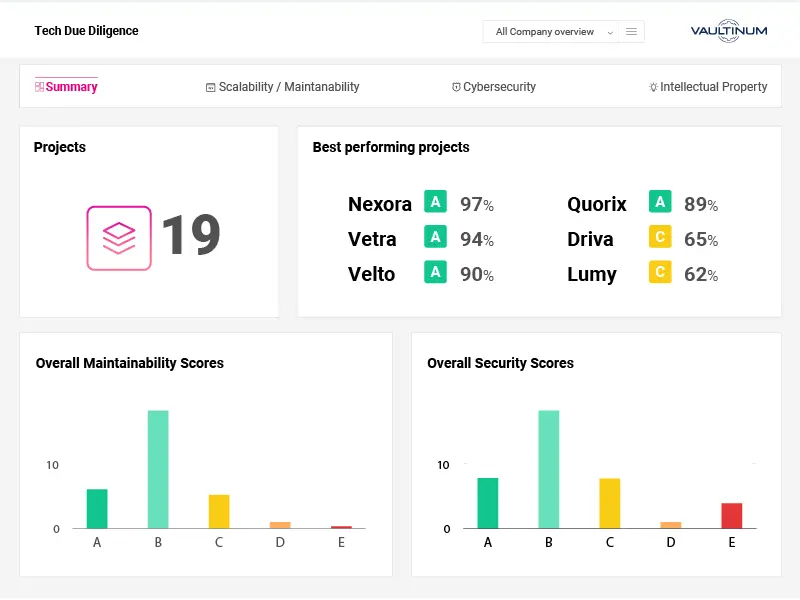

Standardised, board-ready reports across all companies—no more decoding inconsistent formats or tech jargon.

Track progress and tech KPIs that matter, spot red flags, and measure value creation with regular insights throughout the investment cycle.

Ensure tech execution stays in sync with business objectives—across every asset, from entry to exit.

Our clients

How continuous diligence supports private equity

Consistent, standardised reporting

Vaultinum delivers fact-based board-ready updates across all portfolio companies in a uniform format.

Financially aligned insights

We translate technical metrics into business-relevant language, helping you assess value creation and risk clearly.

Ongoing oversight

We track tech execution over time, not just at acquisition or exit allowing you to spot issues early and measure progress in real-time.

Faster, cleaner exits

At exit, you already have full visibility on the roadmap execution and tech performance. Our reporting becomes your VDD.

How continuous diligence supports portfolio companies

We handle the reporting

Vaultinum manages the creation and delivery of board-level updates—so you don’t have to.

Focus on delivery, not decks

Free your time from slide-making and board prep. We keep stakeholders informed so you can stay in the code.

Expert-backed performance reviews

Our tech experts interpret the data, flag risks, and offer strategic guidance that’s investor-aligned.

No surprises at exit

Continuous snapshots ensure your tech evolution is documented and exit-ready at all times.

A unique combination of tools, data and experts

All-in-one platform to assess and report on performance

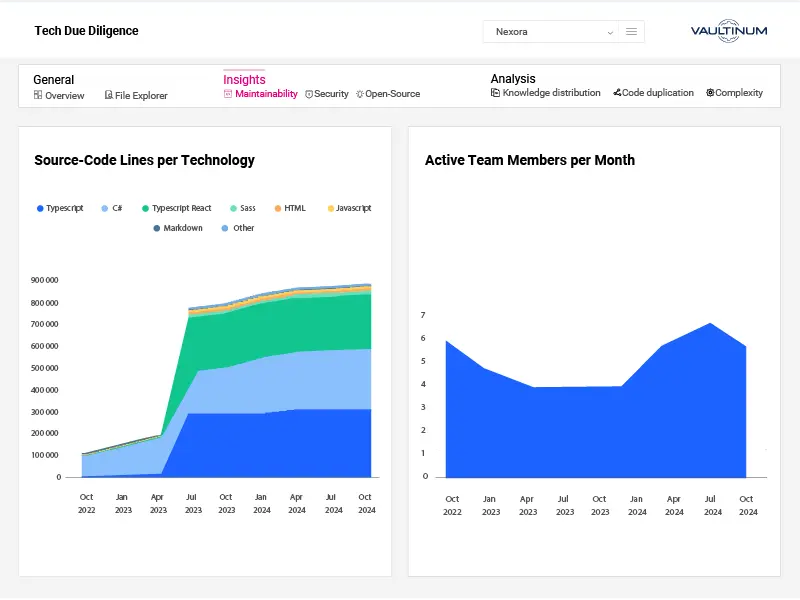

Our dashboard provides regular updates on the PortCo’s technology performance, tracking progress against business objectives and highlighting areas requiring attention.

One central platform

Hosting all reports from initial tech due diligence to exit, ensuring consistency and traceability throughout the investment period.

Periodic, light-touch assessments

to evaluate key indicators such as cybersecurity posture, scalability, roadmap execution, licensing exposure and team performance.

Detailed code analysis

Full code scan report available, identifying specific issues, enabling tech teams to resolve risks proactively.

Interactive dashboard access

offering company-level and portfolio-wide visibility, supported by benchmark comparisons against industry standards.

Expert consultations

providing access to senior tech specialists for contextualised insights and strategic alignment when needed.

Final exit-ready report

drawing on accumulated findings and scans to support a seamless transition to Vendor Due Diligence, with no need for reassessments or rework.

How continuous diligence works

01

Technology Due Diligence

02

Periodic tech checks

03

Board ready reporting

04

VDD ready

01

360 Technology Due Diligence

- Online assessment and code scan for data-led evaluation, mitigated by our experts

- TDD report highlighting strengths, vulnerabilities, tech debt and growth potential

- Detailed scan report and online assessments available to guide the tech team

- Delivery of an operational roadmap to align tech developments on business strategy

02

Periodic tech checks

- Periodic incremental Tech DD with code scan

- Results viewable 24/24 on the Dashboard

- Measures progress on cybersecurity, OSS usage, Team performance, roadmap delivery, costs

- Guidance from Vaultinum’s team of experts

03

Board ready reporting

- Analysis of the KPis

- Preparation of the reporting document

04

Accelerated VDD

- State of the Tech assessment downloadable from the dashboard

- Internal alignment on results

- Vaultinum prepares the final VDD deck, highlighting strengths, security, scalability, leadership

- Q&A preparation session if needed

Designed for both private equity investors and CTOs, this solution provides clear insights into tech risks and growth opportunities, to maximise exit valuation.”

Philippe Thomas, CEO of Vaultinum

Tech Due Diligence Checklist

Key questions you don’t want to miss when performing a Tech Due Diligence

FAQ Portfolio Monitoring

What is portfolio monitoring?

Portfolio monitoring is the ongoing process of tracking the health and performance of investments within a fund. For private equity firms, effective portfolio monitoring provides continuous visibility into each company to identify risks and opportunities. By collecting and analysing data across financials, technology, operations, and compliance, firms gain valuable portfolio insights that inform decision-making and ensure that value creation plans stay on track.

What is portfolio performance?

Portfolio performance refers to the overall results delivered by the investments within a portfolio over a specific period of time. Measuring portfolio performance involves assessing financial returns, operational progress, and technology resilience to understand whether investments are meeting expectations. A clear portfolio report allows investors to compare performance across companies and sectors, ensuring that capital is allocated effectively and risks are managed proactively.

For technology investments, continuous portfolio monitoring ensures that risks such as technical debt, scalability issues, team performance or regulatory non-compliance are identified early and dealt with. These portfolio insights enable investors to safeguard the long-term value of their tech assets and drive sustainable growth across the investment lifecycle.

How to analyse portfolio performance?

Good portfolio performance analysis combines quantitative and qualitative metrics. The process includes evaluating financial metrics, identifying risks in technology and operations, and comparing actual results to planned objectives. With continuous diligence, investors can generate regular portfolio reports that highlight portfolio insights such as growth potential, hidden risks, and performance gaps. These insights enable proactive interventions to protect and enhance value creation.

How to monitor an investment portfolio?

To effectively monitor an investment portfolio, private equity firms need a systematic approach that provides both depth and frequency of analysis. This includes continuous portfolio monitoring through automated data collection and recurring portfolio assessments to ensure investments remain aligned with strategic goals. Modern solutions like Vaultinum’s Continuous Diligence deliver regular portfolio reports and board-ready portfolio insights, allowing investors to detect early warning signs, evaluate performance evolution vs previous assessment, and make informed decisions throughout the investment lifecycle.

Why is portfolio monitoring important for private equity?

Portfolio monitoring is essential for private equity because it provides investors with continuous visibility into the performance and risks of their portfolio companies. A structured portfolio assessment, supported by independent oversight, ensures that critical aspects such as technology roadmap progress and delivery risks are objectively evaluated.

With investor-focused portfolio insights, complex technical metrics are translated into clear business value, helping investors identify deviations that could impair long-term performance. Regular portfolio reports on technology KPIs, aligned with strategic objectives, deliver board-ready updates that highlight both progress and key performance shifts. This level of transparency not only strengthens governance but also accelerates exit-readiness by ensuring that risks are managed proactively and value creation is continuously monitored throughout the investment lifecycle.

What KPIs should private equity firms track in portfolio assessment?

In a portfolio assessment, private equity firms should track a combination of financial, operational, and technology KPIs to ensure a comprehensive view of portfolio performance. Core financial indicators include revenue growth, EBITDA, and cash flow, while operational KPIs cover efficiency, customer acquisition costs, and retention rates. For technology-driven companies, additional KPIs such as product roadmap progress, scalability, cybersecurity posture, and technical debt are critical. Continuous portfolio monitoring with regular portfolio reports ensures these KPIs are consistently measured against strategic objectives, giving investors the insights they need to detect risks early and drive priorities according to the growth development plan.

How can portfolio insights support value creation strategies?

Portfolio insights provide private equity firms with the clarity needed to design and execute effective value creation strategies. By transforming raw data from portfolio monitoring into actionable intelligence, investors can identify growth opportunities, performance gaps, and emerging risks across their portfolio companies. Regular portfolio reports highlight where operational improvements, technology upgrades, or strategic pivots can unlock greater value. This proactive approach ensures that portfolio assessments are not only diagnostic but also prescriptive, enabling investors to accelerate value creation initiatives and enhance exit-readiness.

Our latest articles on